Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 31, 2022

By Erik Meyer and Maria Lupachik

Sao Tome and Principe has a chance to become a new oil producer in case of positive results of the recently spudded Jaca-1 new-field wildcat, targeting a Cretaceous-aged basin floor fan. The prospect is located within the offshore Block 06 operated by Portugal's Galp Energia with Royal Dutch Shell as a technical operator. Jaca-1 is the first-ever offshore well to be drilled in Sao Tome and Principe exclusive economic zone (EEZ) and also the first exploration well in distal Gabon-Douala Deep Sea Basin. If successful, the well will prove a working petroleum system in the deep offshore area outboard of the Douala, Rio Muni, and Gabon Coastal basins.

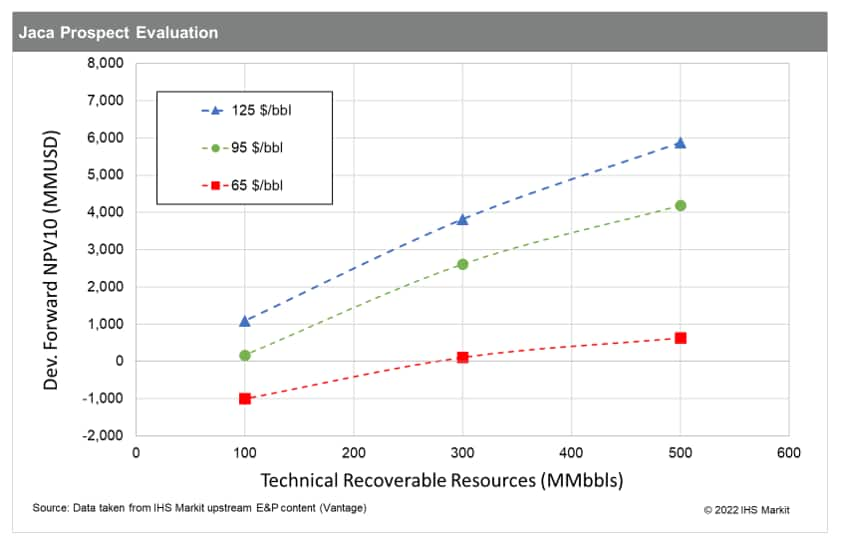

The well is currently being drilled by the Maersk Voyager drillship at a water depth of around 2,500 m, targeting a probe at a total depth of about 4,500 m. If successful, the possible development of the field would involve a floating production, storage and offloading (FPSO) vessel with offshore loading onto shuttle tankers to export the crude oil to market. With prevailing and forecasted oil price expected to remain over $90/bbl until the end of 2023, at $95/bbl the minimum economic field size (MEFS) is estimated to be in the region of 100 MMbbls recoverable, while a discovery of 300 MMbbls is expected to have a NPV of over USD 2.5 billion. At a more conservative Brent oil price scenario of $65/bbl Galp Energia is likely targeting at least 280 MMbbls recoverable, while a discovery of 500 MMbbl will have a value in the region of half a billion USD, with IRR of 10%, a government take less than 40% and a break-even price around $60/bbl. It is worth highlighting that the light oil nature of the crude leads to a quality related price adjustment equal to almost $4/bbl.

Should Jaca-1 be a success, it has the potential to de-risk prospective resources in the Gabon-Douala Deep Sea Basin and play a key role for the future exploration activities within Sao Tome and Principe.

Figure 1: Jaca prospect valuation

For more information regarding well, field & basin summaries, please refer to EDIN.

For more information regarding asset evaluation, portfolio view, and production forecasts, please refer to Vantage.

For more information regarding our country activity report, please refer to GEPS.

For more information regarding E&P costs please refer to IHS Markit Que$tor.

Posted 31 May 2022 by Erik Meyer, Senior Technical Research Analyst, S&P Global Energy and

Maria Lupachik, Sr Technical Research Analyst, Upstream Energy, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.