Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 25, 2024

By Charles Ross and Laurence Bird

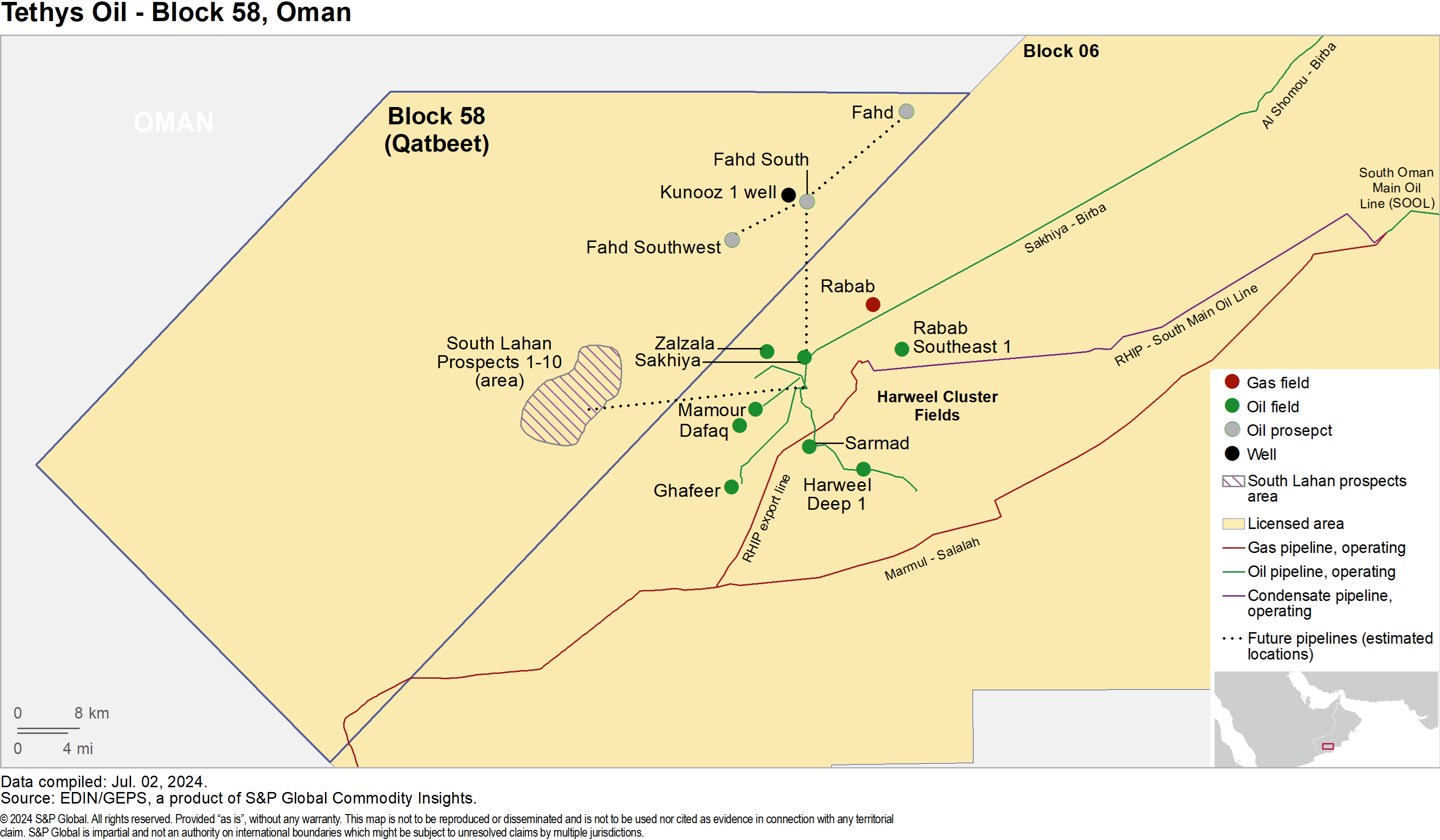

Figure 1

In February 2024, Tethys Oil initiated a portfolio review due to the company's management perceiving its market capitalization to be undervalued. This year is crucial for Tethys as it submitted a field development plan (FDP) for Block 56 and is planning a high-impact exploration well in Block 58, which could have transformative effects if successful. Additionally, the production from Block 3 & 4 is vital for generating capital to fund these potential projects, however, with production declining and an impairment of $36.9 million at the end of the fourth quarter in 2023, Tethys will be looking to boost production as soon as possible.

Block 58 in Oman was awarded to Tethys Oil in 2020 with a 100% interest share. Over the past four years, the company has been interpreting existing seismic and well data, with two previous wells showing hydrocarbon shows within multiple plays. Some of these plays are already proven within Block 3 & 4, while others have yet to be tested. The main targets within the block are South Lahan and Fahd. The South Lahan area aims to tap into a proven light oil play found in the Harweel area of neighboring Petroleum Development Oman LLC's Block 6. In the north of the block, the main play target is the intra-carbonate stringers within the Ara Formation, with the Kunooz-1 well targeting 120 million barrels of oil of unrisked recoverable prospective resources. The well is expected to reach a total depth of 3,800 m and may yield results in fourth quarter 2024.

Depending on the results of the Kunooz-1 well, Tethys may drill a second well in either Fahd or South Lahan in the southern part of the block. If Kunooz-1 proves successful, the size of the project may necessitate a partner to assist with further appraisal and development across the block, requiring significant capital investment.

Block 58 - commercial summary

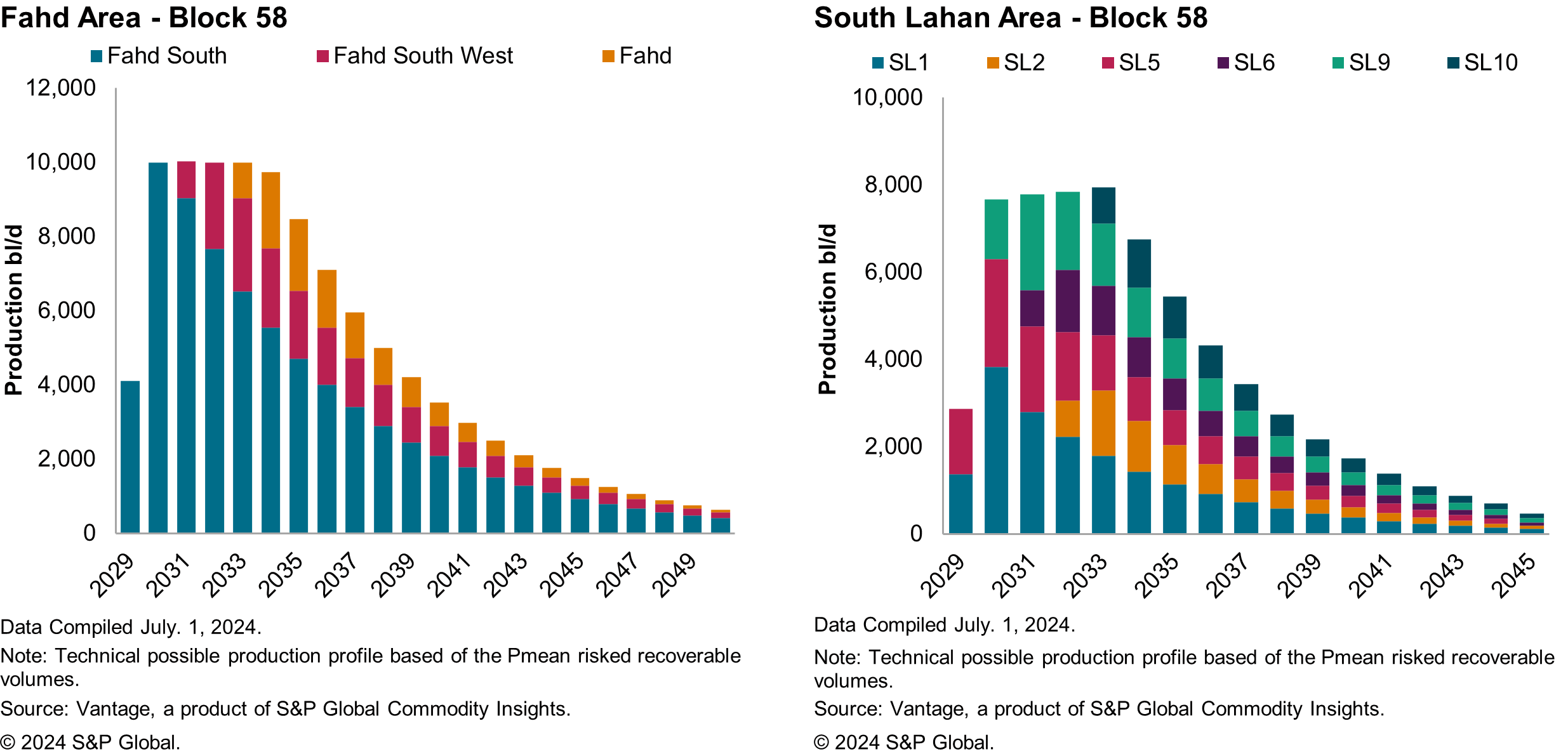

The Fahd area within Block 58 and the South Lahan area could both hold significant potential value for Tethys. According to the independent audit report (IAR) released in April 2024, the risked Pmean volumes in the Fahd Area equate to 37 million barrels of recoverable oil, which would likely be commercially viable based on economic modeling. Production from the Fahd area could reach around 10,000 b/d by Fahd South and then backfilled by Fahd Southwest and Fahd if both are successful (Figure 2). Similarly, the South Lahan area has an estimated risked Pmean recoverable resource of approximately 23.8 million barrels of oil. If successful, the South Lahan prospects could contribute significant production, with a peak production rate of around 7,800 b/d that could be sustained for several years with timely development (Figure 3).

Figure 2 & 3

Both areas could come online by 2029, if timely appraisal and development is conducted, with peak production being reached from 2030. The development of both areas is likely to be similar and would require new infrastructure, in the form of a central gathering manifolds, new development and water injection wells and associated in-field pipelines. From the site of the Kunooz-1 exploration well, the Harweel Cluster is around 22 km away in the neighboring Block 6, which has existing oil and gas infrastructure which would be utilized for a tariff. The associated gas from both the projects could be monetized through export from the gas infrastructure at the Harweel Cluster, or it could be used to generate power for the project at the Rabab Harweel powerplant to provide electricity to the projects.

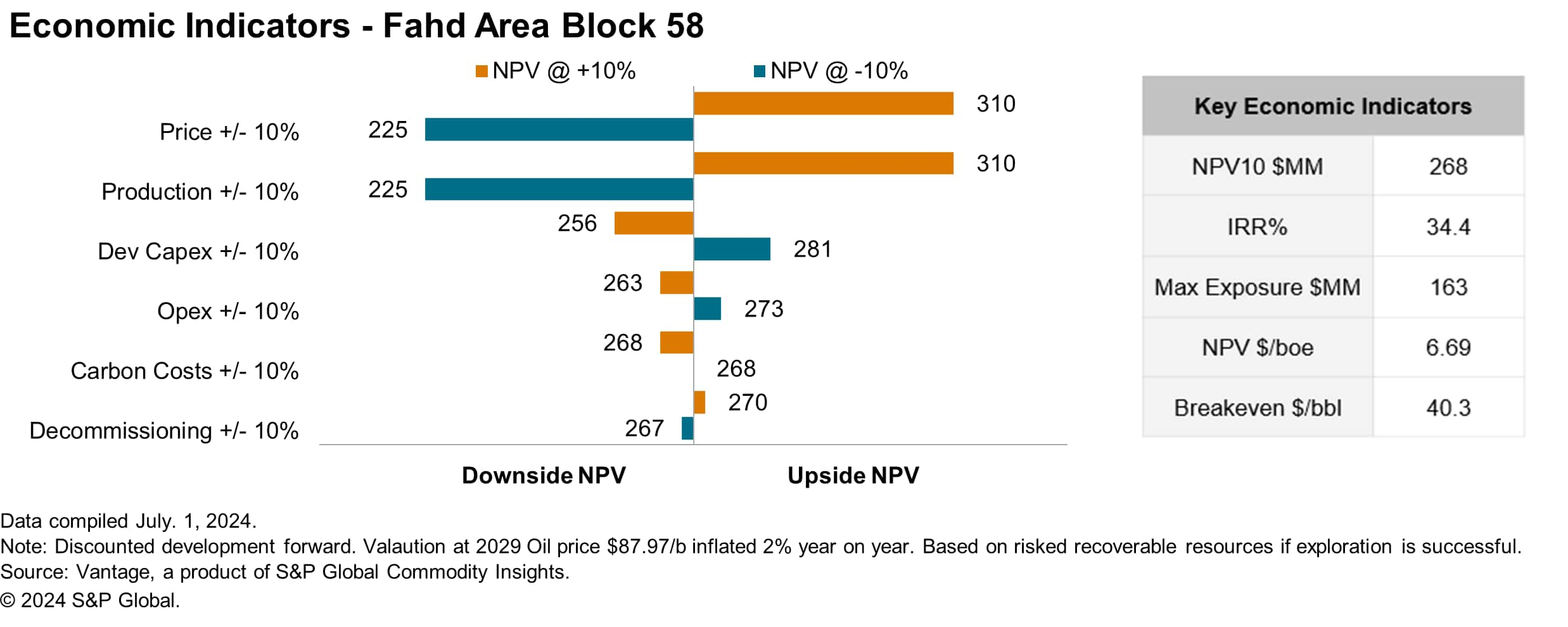

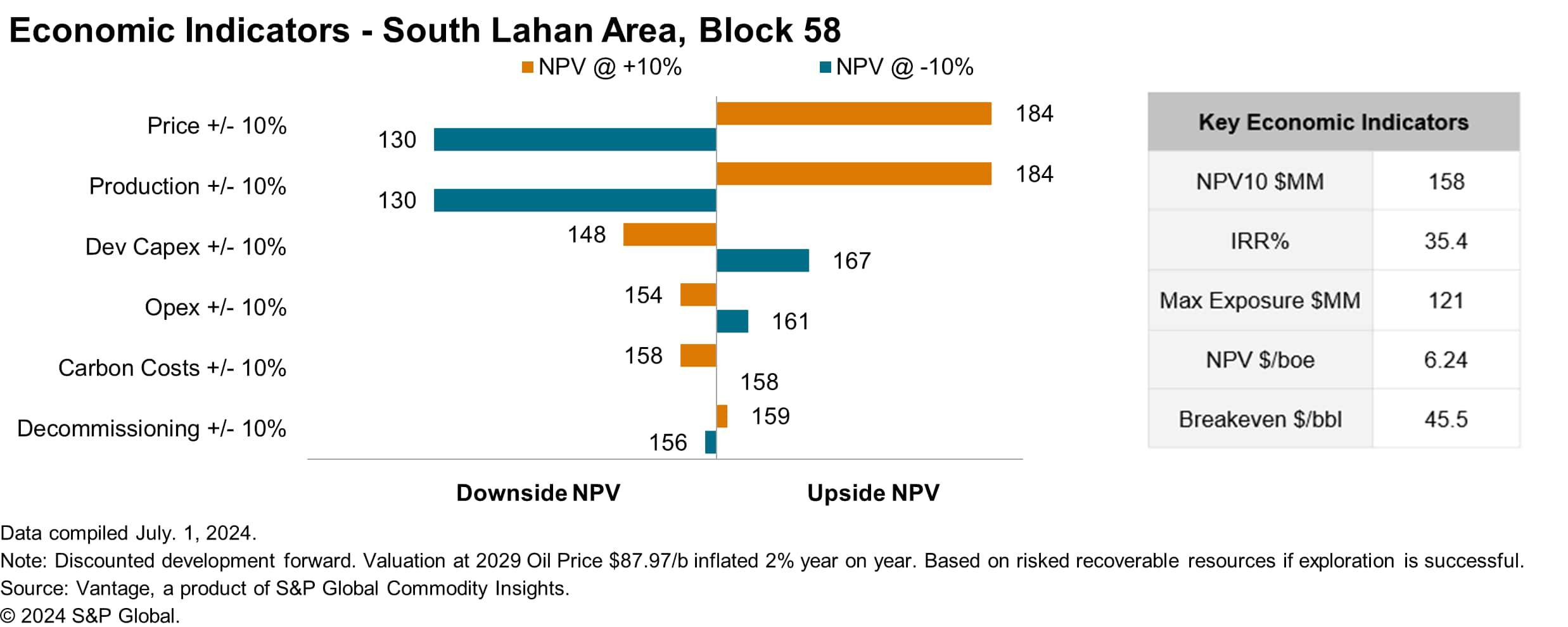

The two areas both show strong project economics, high rate of returns and sufficient lifecycle cashflow based on the assumptions made and the discovered volumes are in line with the Pmean recoverable volumes estimated from the IAR. Break-even prices for the Fahd Area are around $40/b (Figure 4) and slightly higher at $45/b (Figure 5) for the South Lahan Area. This is due to the recovery per well estimates for the South Lahan Area are forecast to be lower than that at Fahd, coupled with lower forecast production rates and similar capital requirements to develop both of the projects.

Figure 4

Figure 5

Emissions overview

Block 58's emissions projections are favorable for Tethys with emissions intensities well below the 2022 average for Oman of 28 kilograms of CO2 equivalent per barrel of oil equivalent (kgCO2e/boe). Estimates were made for carbon dioxide, methane and nitrous oxide, and for the individual sources including, diesel, flaring and venting for the Fahd area and South Lahan. Flaring and venting volumes are expected to track with production and were modelled using metrics specific to the development concept. Diesel volumes were modelled separately for each project in QUE$TOR with these volumes used to estimate emissions.

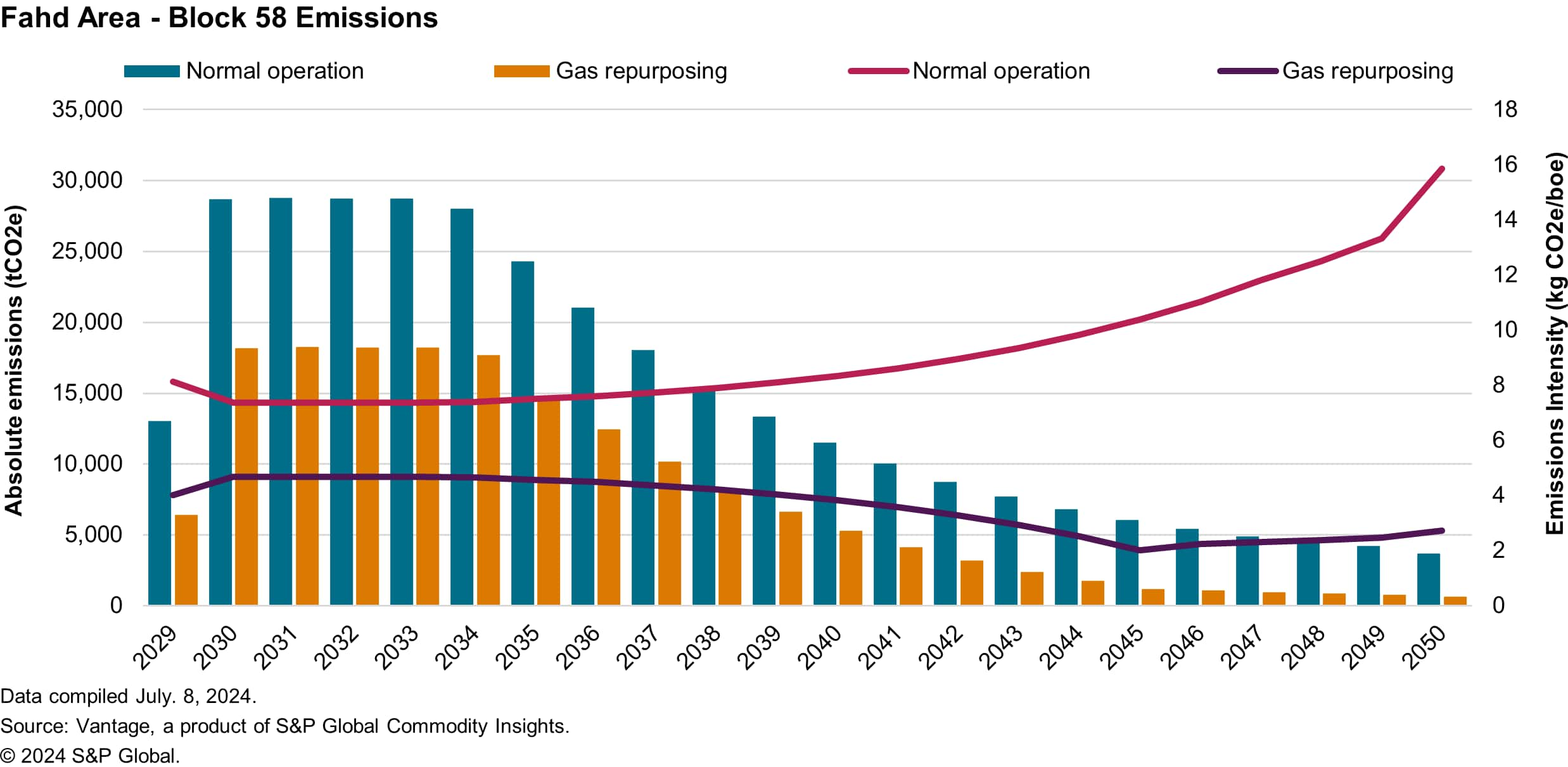

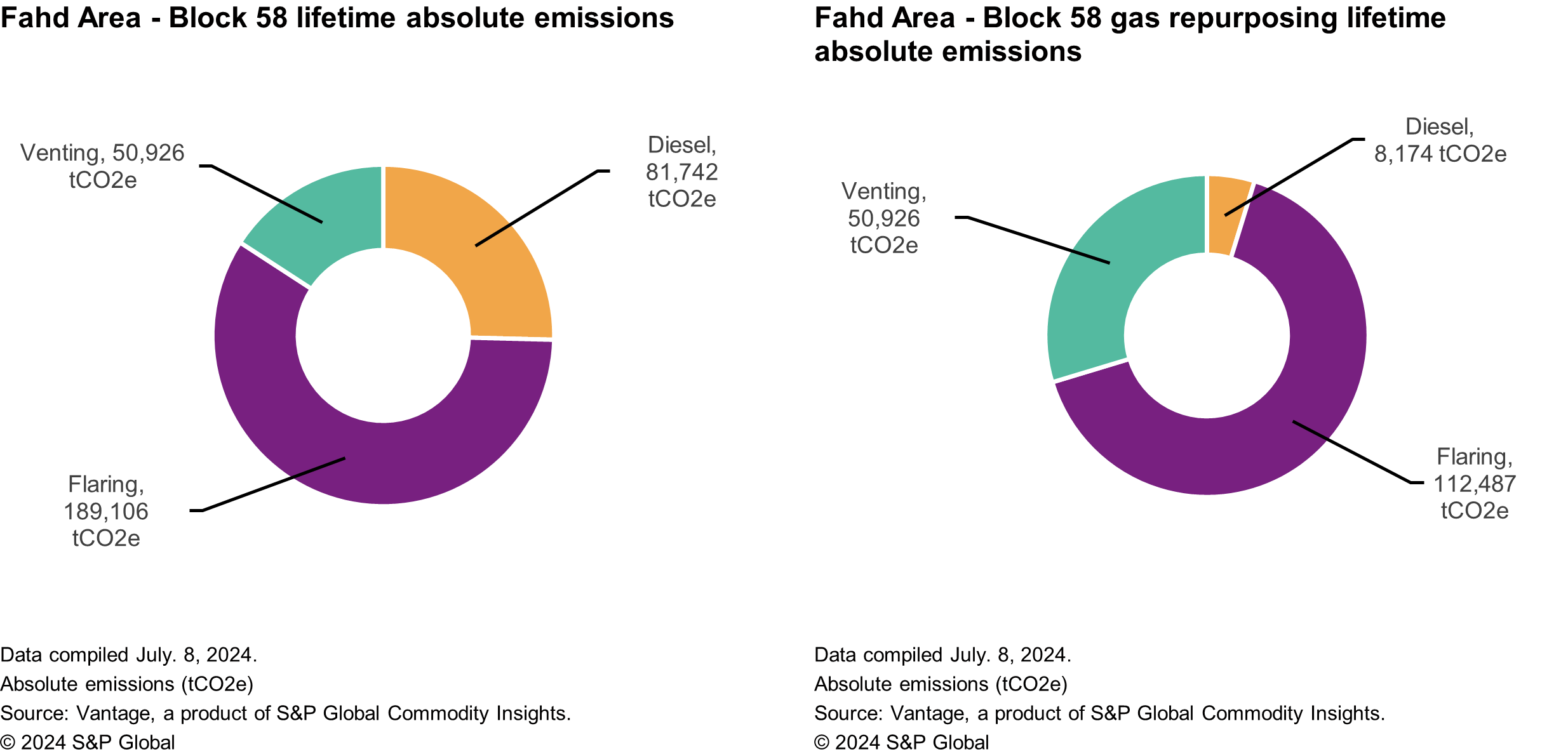

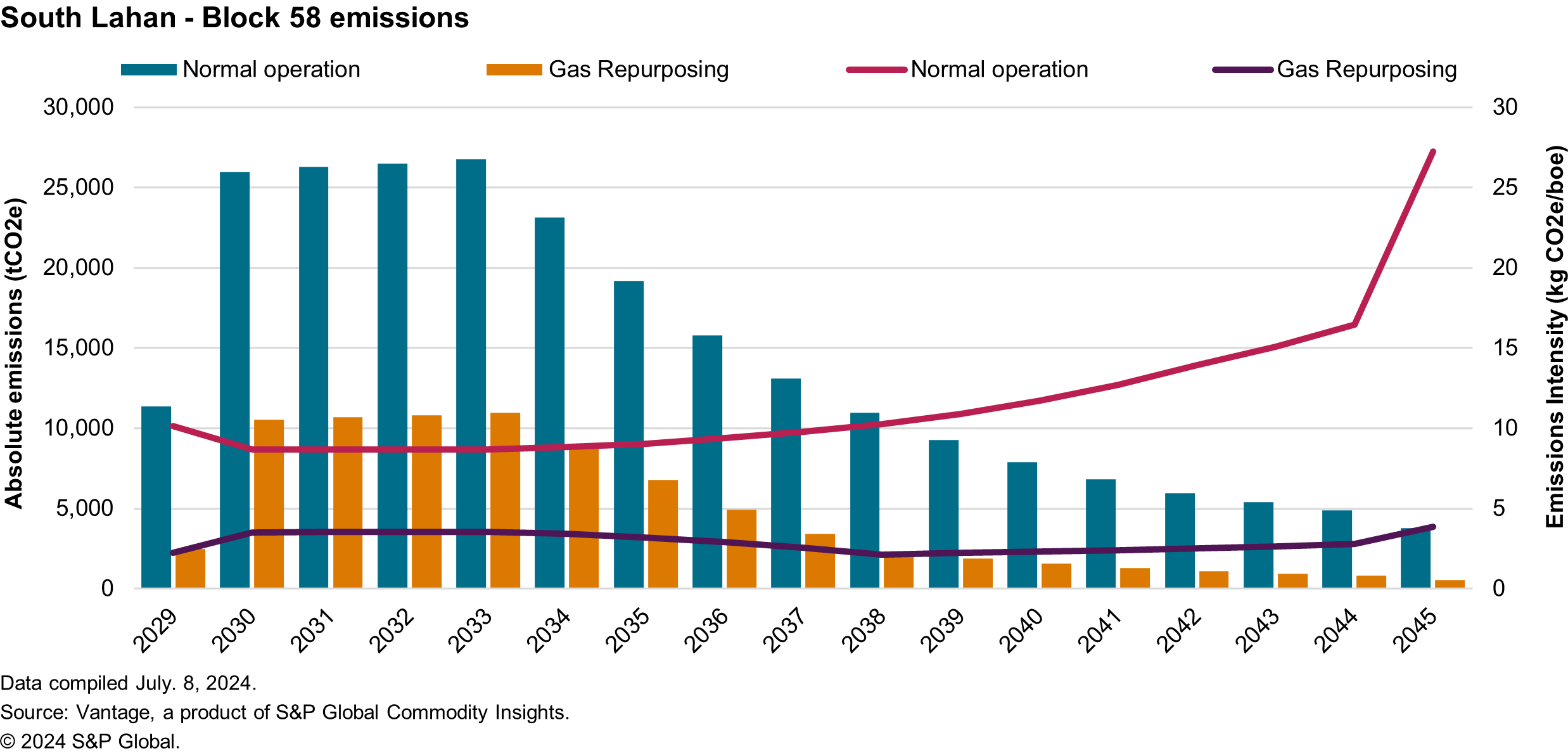

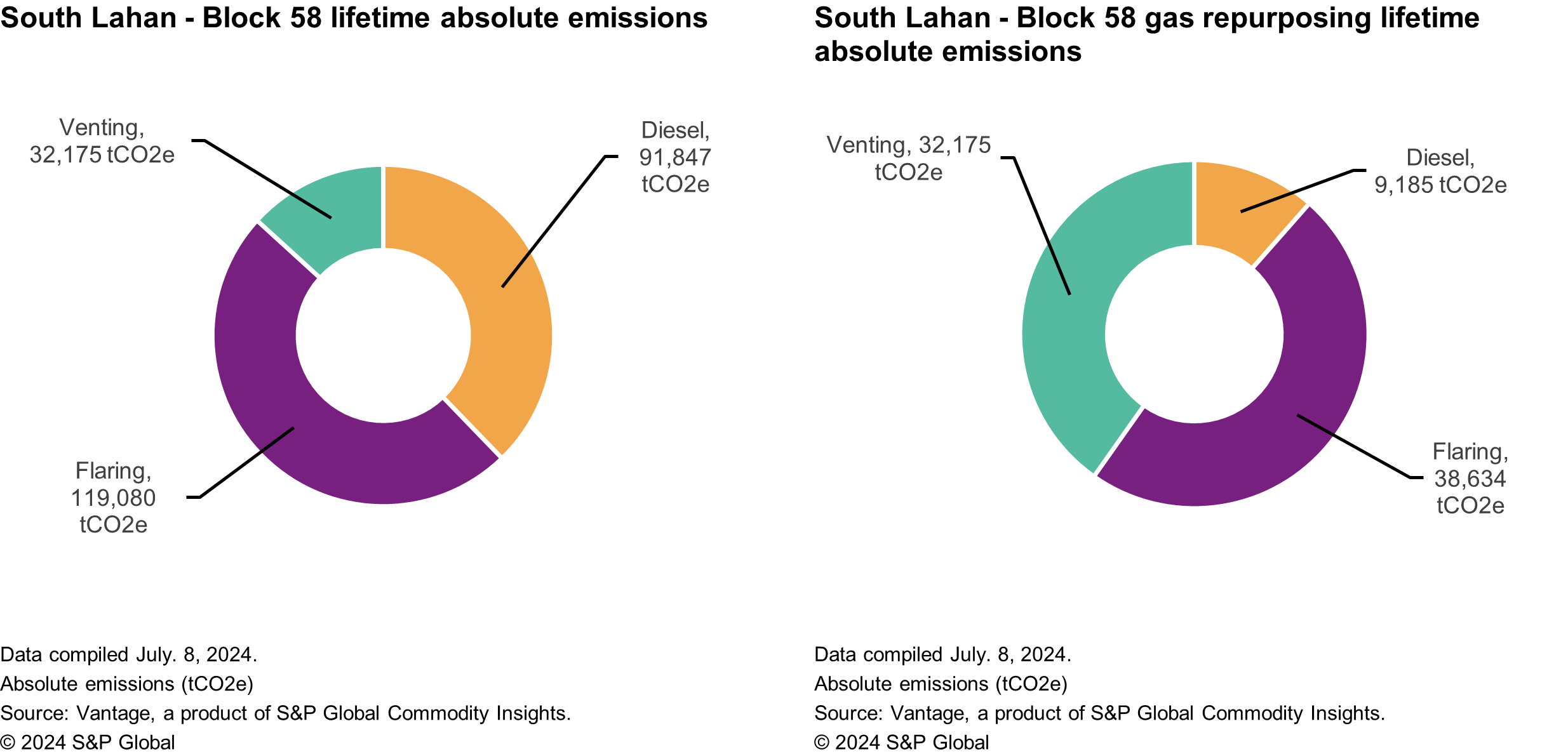

Absolute emissions for the Fahd area are projected to peak with production between 2030 and 2034 with 29,000 metric tons CO2e (tCO2e) emitted per year, which results in an emissions intensity of approximately 7 kgCO2e/boe (Figure 6). As production decreases later in the project's life cycle the emission intensity is projected to rise but remain lower than the average for Oman. Flaring will likely make up most of the Fahd areas emissions (59%) with diesel combustion making up 25% of emissions and venting 16% (Figure 7). Emissions for the South Lahan are projected to be similar to the Fahd area with absolute emissions peaking with production in 2033 at 27,000 tCO2e with projected emissions intensities of about 9 kgCO2e/boe (Figure 9). Again, as production declines in the project's life cycle the emission intensity will likely rise but is estimated to remain lower than the average for Oman, only rising above the average in the final year of production. Flaring is envisaged to be the main emission source (49%) for the South Lahan area with diesel emissions likely making up 38% and venting 13% of the total lifetime emissions (Figure 10).

While the low emissions intensities projections are good for Tethys, the large contribution to emissions from flaring is likely to become challenging. Oman has plans to become net zero in emissions by 2050 and is also a signatory to the World Bank's zero routine flaring by 2030 initiative. To meet these targets Oman has identified repurposing flared gas as a way to cut 1.8 million metric tons CO2e of flaring emissions. For Tethys this means that its main emissions source is a target for Oman's emission reduction plan, which will have an associated cost.

Flare gas from Block 58 could be repurposed to generate power for the block by exporting the gas that would have been flared to the Harweel cluster and receiving power back via the electrical grid. This has the potential to cut flaring and diesel emissions as the imported power would replace diesel generators, limiting their use to a backup system. Figure 6 shows that for the Fahd area repurposing flare gas for fuel reduces emissions by approximately 37% during peak production with this increase to about 80% towards the end of production as the overall amounts of flaring decreases. A similar trend is seen for the South Lahan area where repurposing flare is estimated to reduce emissions by 60% during peak production with this increase to about 85% towards the end of production (Figure 9). Repurposing flare gas helps to prevent the rise in emissions intensity for both projects that occurs towards the end the production life cycle when production volumes decrease. Even with gas repurposing, flaring is still projected to be a major component of emissions for Fahd and South Lahan (Figures 8 and 11). This is partly due to diesel emissions being projected to decrease but also due to there still being a significant portion of gas that is flared, particularly during the projected periods of peak production. Tethys would likely have to find additional uses for the flare gas to lower flaring emissions and protect against any future costs associated with a carbon tax in Oman.

Figure 6

Figure 7 & 8

Figure 9

Figure 10 & 11

Summary

The company will require significant capital to fund these projects and will likely need the ability to raise substantial debt, especially if both areas are successful. Tethys could bring in a partner to the project, to leverage another operator's operational experience and decrease the risk and exposure it has to the project. Tethys could do this via a farm-out option to realize some of the value if Kunooz-1 is successful, while potentially getting favorable terms through the appraisal campaign with a possible carry in some of the appraisal or development costs. This could be the best way to deliver short- and longer-term value to its shareholders while it continues to focus on streamlining its operations and associated costs at its producing assets.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.