Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

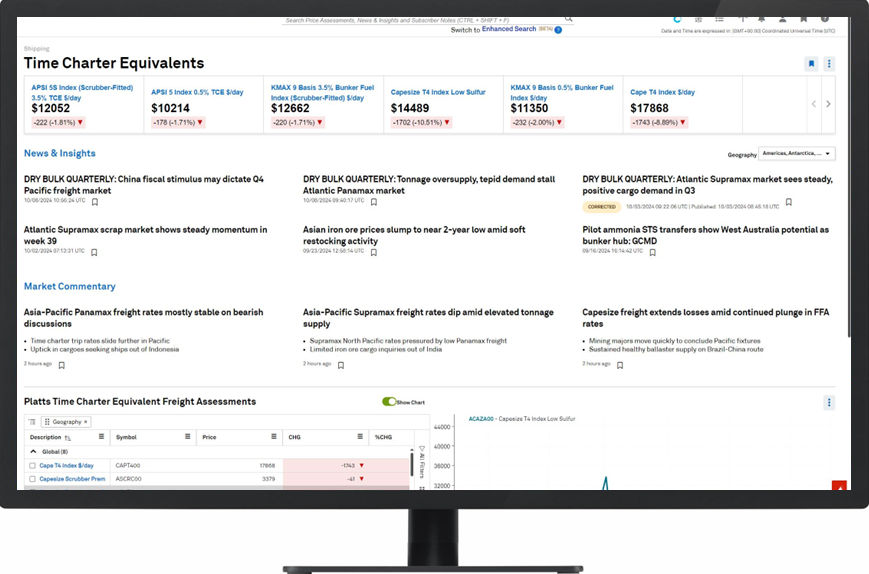

Navigating short-term decisions on commodity flows, freight rates, and bunker fuel.

Not sure what plan is right for you? Contact our team and we’ll find the subscription that works for you.

Understanding shifts in trade, commodity supply, and freight capacity is crucial for navigating price outlooks, while changes in bunker fuel and freight rates significantly influence operational costs. Commodity and freight traders, investors, fleet operators, governments, and various stakeholders in global commodity value chains need clear shipping insights to capitalize on opportunities and risks.

Our shipping insights portfolio delivers comprehensive shipping market insights on commodity movements, supply and trade trends, fleet dynamics and rate forecasts, empowering decision-makers with research, news, analytical tools, APIs and more. Designed to support short-term decision-making needs, S&P Global Energy is your go-to source for shipping data analytics services that illuminate the impacts of commodity and fleet movements on operational costs and market opportunities.

With the most comprehensive data analytics in shipping industry package, we offer you a 360-degree view of shipping market trends. By consolidating and detailing critical information on routes, rates, vessel capacity, fuel costs, fuel availability and freight supply and demand.

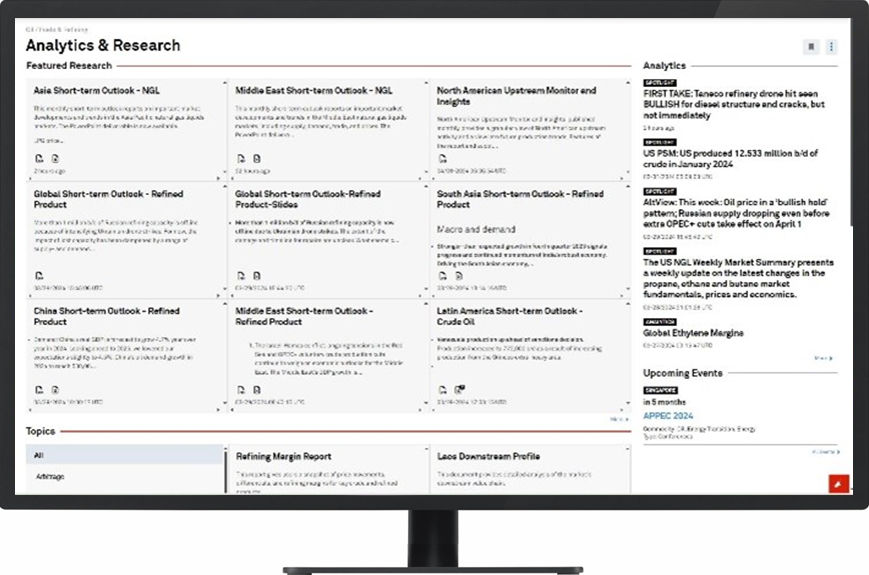

Get analytics based, impartial freight market insights to navigate maritime volatility. Developed in partnership with the Baltic Exchange. Leveraging over 3,000 data points and deep market knowledge, our model connects macroeconomic factors to freight rates using machine learning. Clients receive weekly and monthly updates for up to three years, aiding in strategic decision-making.

A comprehensive, unbiased evaluation of the dry freight market, combining shipping insights from brokers, shipowners, and charterers. It delivers daily price assessments, fundamental analysis affecting freight ratesprices, and over 250 independent freight rate updates, along with detailed freight shipping news and fixture analyses.

The Freight Market Insights Outlook Service utilizes proprietary oil and trade flows data from the World Oil Market Forecast, to develop a monthly shipping market report and forecast of tanker ton-mile demand and vessel demand in the key tanker size sectors. The service also provides access to our transportation analysts to address client questions and a database of both historic and forecast tanker shipping industry statistics.

Get analytics based, impartial freight market insights to navigate maritime volatility. Developed in partnership with the Baltic Exchange. Leveraging over 3,000 data points and deep market knowledge, our model connects macroeconomic factors to freight rates using machine learning. Clients receive weekly and monthly updates for up to three years, aiding in strategic decision-making.

A comprehensive, unbiased evaluation of the dry freight market, combining shipping insights from brokers, shipowners, and charterers. It delivers daily price assessments, fundamental analysis affecting freight ratesprices, and over 250 independent freight rate updates, along with detailed freight shipping news and fixture analyses.

The Freight Market Insights Outlook Service utilizes proprietary oil and trade flows data from the World Oil Market Forecast, to develop a monthly shipping market report and forecast of tanker ton-mile demand and vessel demand in the key tanker size sectors. The service also provides access to our transportation analysts to address client questions and a database of both historic and forecast tanker shipping industry statistics.

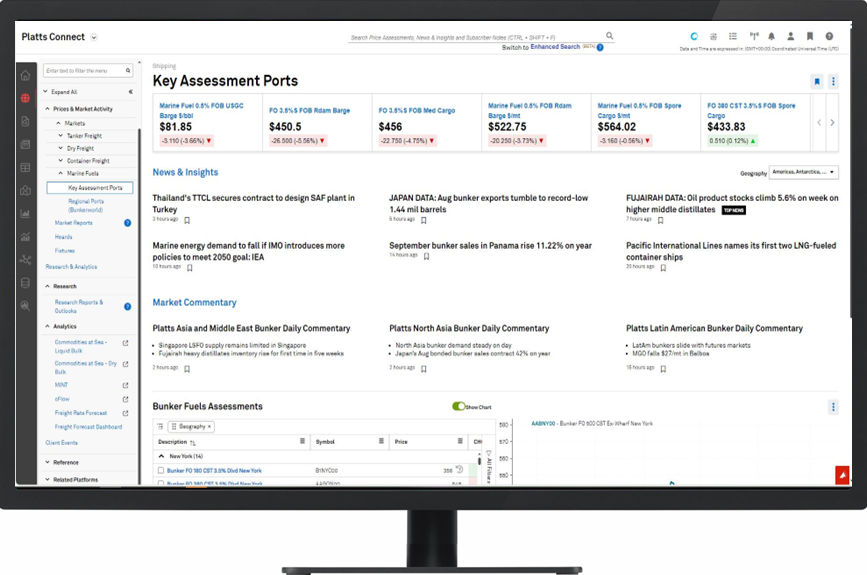

Offers a daily snapshot of the global bunker fuel markets, featuring the latest prices for major ports and key market shipping market insights. With Platts price assessments for over 80+ major ports, crucial news, and feedstock data -it's essential for high-volume negotiations. Our global team ensures timely updates on end-of-day prices, regional analyses, and transparent benchmark assessments, including bids, offers, and trades.

Offers a daily snapshot of the global bunker fuel markets, featuring the latest prices for major ports and key market shipping market insights. With Platts price assessments for over 80+ major ports, crucial news, and feedstock data -it's essential for high-volume negotiations. Our global team ensures timely updates on end-of-day prices, regional analyses, and transparent benchmark assessments, including bids, offers, and trades.

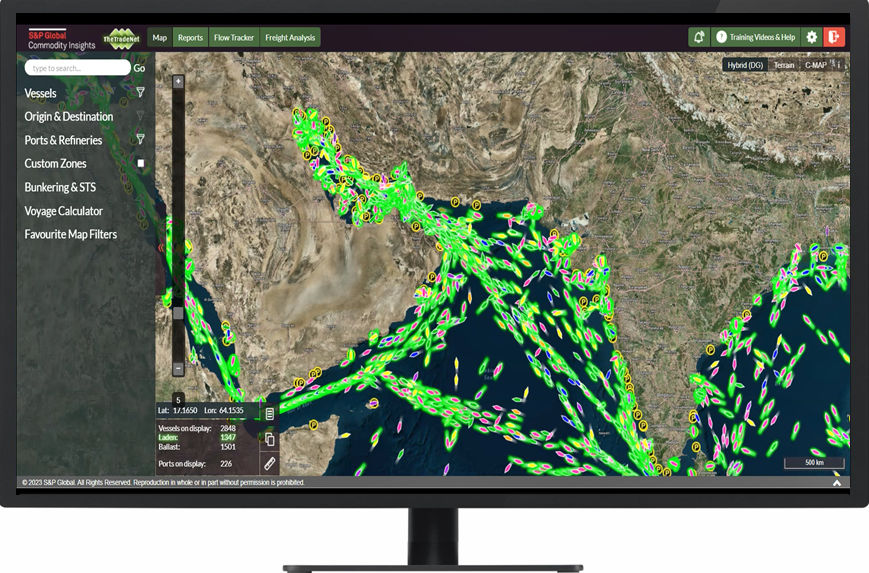

This tool provides in-depth visibility into vessel and fleet analyticsdata all delivered through a user-friendly interface. Optimize route planning, enhance cargo management, and streamline operational efficiency. Its unique configuration also makes it the ideal bunker fuel sales intelligence tool that can support market entry planning and market share analysis.

This tool provides in-depth visibility into vessel and fleet analyticsdata all delivered through a user-friendly interface. Optimize route planning, enhance cargo management, and streamline operational efficiency. Its unique configuration also makes it the ideal bunker fuel sales intelligence tool that can support market entry planning and market share analysis.

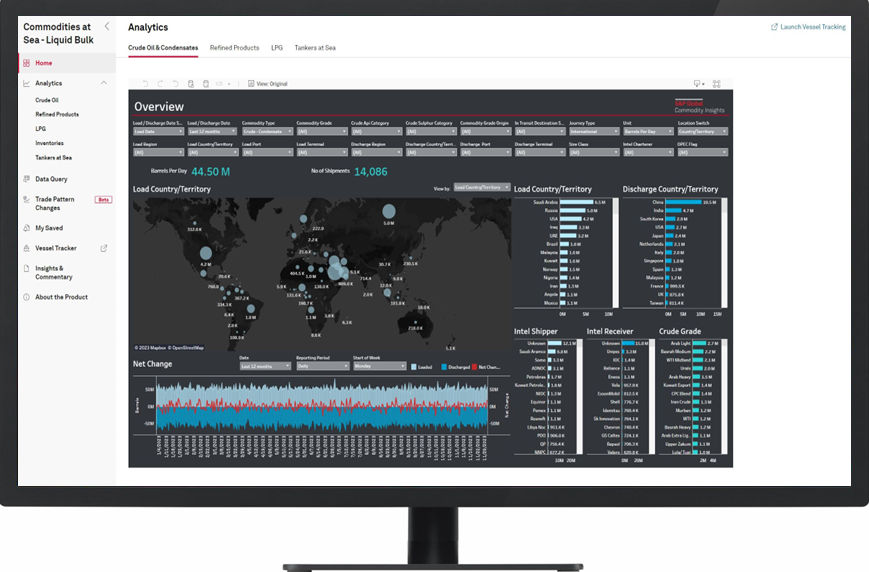

A high frequency market intelligence service that provides visibility into commodity supply, trade activities, trade relationships, and fleet analytics. CAS reports the cargo volumes and voyage details for waterborne globally traded commodities. It also provides detailed shipping data analysisanalytics on trade flows trends and fleet metrics.

A high frequency market intelligence service that provides visibility into commodity supply, trade activities, trade relationships, and fleet analytics. CAS reports the cargo volumes and voyage details for waterborne globally traded commodities. It also provides detailed shipping data analysisanalytics on trade flows trends and fleet metrics.

Get the edge in today’s global markets with our Essential Intelligence® delivered through the providers and platforms which suit you.

We have a global team of experts with years of experience in the shipping industry.

We offer an unmatched level of depth and transparency in shipping data.

Leveraging data-drivenshipping data analysis to provide unbiased perspectives on shipping market trends and opportunities.

Interested in this product?

Complete the form and a team member will reach out to discuss how our solutions can support you.