Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Non-Ferrous

March 24, 2025

By Anne Barbosa

HIGHLIGHTS

New projects most impacted by current price scenario

Bolivia lags in lithium mining despite largest resources

Chile to fall to fourth in global lithium production by 2029

Weak lithium prices since the 2023 collapse continue to pose challenges for advancing new projects in South America's Lithium Triangle.

Bolivia, part of the lithium-rich zone with Argentina and Chile, is lagging behind. It operates only one low-capacity plant, despite having the world's largest lithium resources, as reported by the US Geological Survey. Bolivia has three projects in development, but progress is slow, according to S&P Global Market Intelligence data.

Despite the challenging price environment, the Lithium Triangle is still seen as key in the global race for lithium supply, which is essential for electric vehicle battery production.

A source linked to Bolivia told Platts that 2024 was a pivotal year for the country, as it marked the beginning of industrial production. The state-owned company Yacimientos de Litio Bolivianos has a nominal production capacity of 15,000 mt/year but produces only 3,000 mt/year.

"This stark disparity highlights the urgent need for Bolivia to accelerate its efforts if it hopes to compete effectively in the burgeoning lithium market," the source said.

Platts, part of S&P Global Energy, assessed FOB Lithium Triangle prices at $9,300/mt on March 24, down 7% since its launch in September 2024. In the medium term, spot sales from the region are expected to remain low, as most companies are locked in offtakes and long-term contracts or shipping material to their own subsidiaries.

A significant obstacle for Bolivia in the lithium race is the rainy season, which lasts approximately five months each year and severely impacts production capabilities. Unlike Chile and Argentina, where extraction processes are less hindered by weather, Bolivia's rainy season leads to significant delays.

Bolivia's legal framework presents another challenge. Current legislation stipulates that lithium exploration and industrialization are the state's responsibility, effectively prohibiting foreign direct investment. This restriction limits the influx of capital and technology that could enhance production capabilities.

To address these issues, Bolivia signed two contracts in 2024 aimed at expanding lithium extraction. One contract is with the Russian company Uranium One, and the other with a subsidiary of CATL from China, the world's largest battery manufacturer. Both contracts are awaiting approval from the Legislative Assembly.

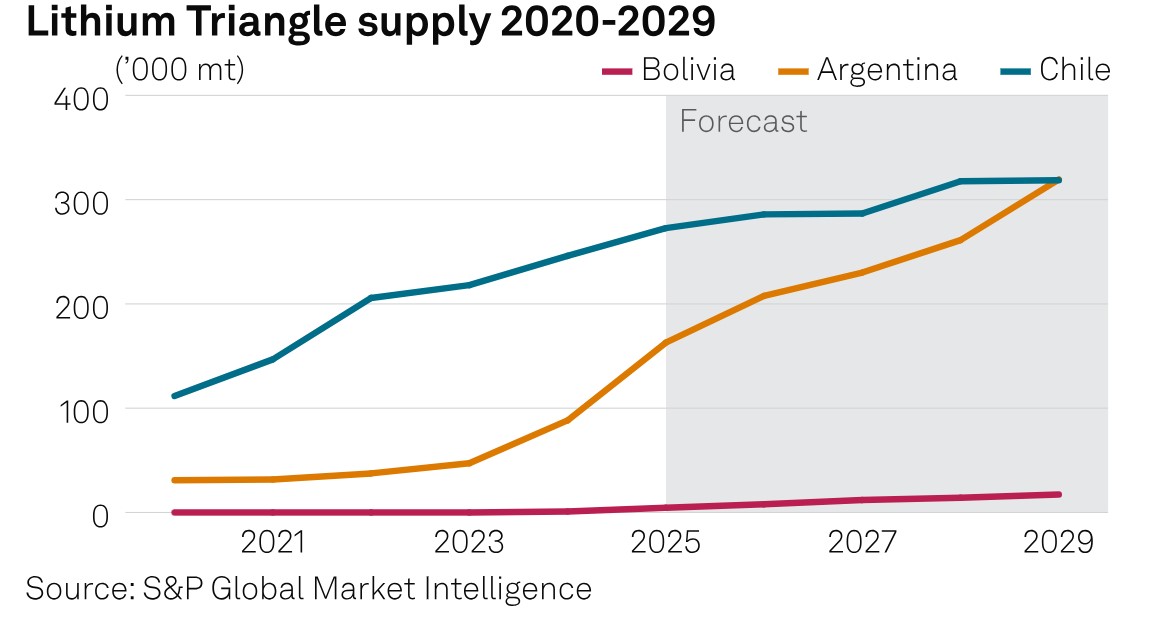

Chile is expected to fall from the world's second-largest lithium producer in 2024 to the fourth largest by 2029, according to S&P Global Market Intelligence. During the same period, Argentina is set to move up from fourth to third place, while Australia is expected to maintain first place and China is projected to rise from third to second place.

Chile lags behind Argentina in the number of projects, with three plants currently operating and a total of 20 projects, Market Intelligence data showed. Nevertheless, it remains the largest producer in the region, with a total supply of 246,096 mt of lithium carbonate equivalent in 2024.

Chile's two lithium producers, Albemarle and SQM, have ramped up production from their operations on the Salar de Atacama to meet surging global demand from the electric vehicle industry.

Four projects are anticipated to commence production in the country in the coming years. Among these, Cleantech Lithium's Laguna Verde project is under development and is projected to begin operations by the end of 2027.

"The demand for lithium, driven by the growth in electric vehicles, remains robust. Currently, projects have been initiated at a rapid pace. We are focusing on our new development program with the aim of entering production as prices begin to rise again," Steve Kesler, chairman of CleanTech Lithium, told Platts.

Although new projects are likely to be most affected by the current lithium price landscape, Argentina is anticipated to boost production more rapidly due to its openness to investors. At least 62 projects are underway in the country, with five operational and 20 at a more advanced stage, according to Market Intelligence data.

France's Eramet and China's Ganfeng began lithium production in Argentina in August 2024. Both plants are in the region of Salta in northern Argentina. Together, they have the capacity to contribute an additional 48,000 mt of lithium carbonate production per year to the country's output.

Imports from both Chile and Argentina, the two largest suppliers of lithium salts to China, accounted for 97.7% of China's total lithium imports, according to Energy.