Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Ferrous, Non-Ferrous

January 13, 2025

By Abdi Salad

HIGHLIGHTS

Potential US tariffs, strong dollar, high China steel exports key bearish factors

Weak European consumption could tighten scrap availability

Sell-side participants in the Turkish deepsea import scrap market are pinning their hopes on tighter availability and improved restocking demand from domestic mills to help scrap prices recover in the first quarter from recent two-year lows, despite a bearish start to the new year, market sources told S&P Global Energy.

The seasonal price rally with the onset of winter was largely stemmed in late 2024, amid weak finished steel demand for Turkish mills, and competitive alternative steelmaking inputs such as steel billet from Asia.

Platts, part of Energy, assessed the benchmark Turkish bulk import premium heavy melting scrap 1/2 (80:20) price at $341/mt CFR Jan. 10, down $5/mt since Jan. 2. The assessment recorded a two-year low of $335/mt CFR on Dec. 12, 2024, and averaged $381.18/mt CFR in 2024, down from an average price of $395.53/mt CFR over 2023, as a series of factors limited upside throughout the year.

As of Jan. 10, the LME scrap forward curve over January-April 2024 was in a soft contango, with the January contract assessed by Platts at $342.50/mt and the February contract at $345/mt. The March and April contracts were assessed at $347/mt CFR and $350/mt CFR, respectively.

This suggests futures traders expect physical scrap prices in Q1 to recover slightly, but that any recovery could be fragile.

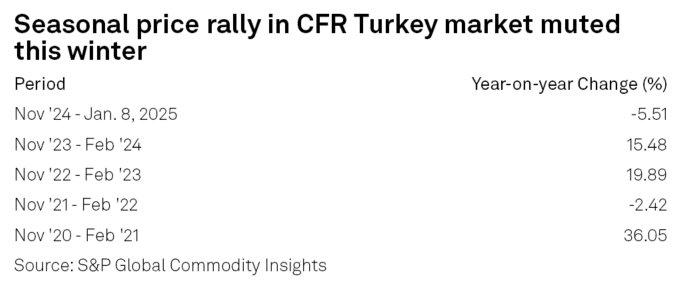

An expected seasonal winter scrap rally in prices was largely muted in the tail end of 2024 (see table), marred by the arrival of previously booked billet from the Far East, softer domestic ferrous scrap demand from European mills -- which made more material available for export -- and the weakness in the euro, prompting more competitive US dollar-denominated export offers from continental recyclers into Turkey.

Platts assessed the euro at $1.0295 Jan. 2, gradually weakening from a 2024 peak of $1.1192 on Aug. 23.

Market participants largely expect the weakness in the euro and poor European domestic demand to persist, providing a bearish outlook for European export scrap prices in 2025.

Additionally, European ferrous scrap collection costs -- which track the price of subsuppliers delivering material to the deepsea export docks -- have not yet increased sharply amid the onset of winter, despite sources suggesting that these relatively low collection prices would slow flows, and thus disincentivize collection from subsuppliers and restrict supply.

Collection costs have recently been reported at Eur285/mt delivered to the docks, although sources said they expect these costs to increase as the winter gets colder across Europe in January and have already increased by Eur5/mt since late December.

Scrap recyclers told Energy that they were pinning their hopes on increasing costs of collecting HMS at the docks, helping to keep CFR Turkey scrap prices firm in Q1. But since the new year, subsuppliers have attempted to increase their prices to no avail, sources said.

However, amid persistently weak scrap demand from European domestic mills and alternative export destinations like India remaining muted, some recycler sources suggested that passing on any higher scrap collection costs to the Turkish mills would be difficult considering the mills' buying power and alternative steelmaking input options -- such as billets. This was despite Turkish crude steelmaking capacity increasing almost 11% year-on-year in 2024 to 65.75 million mt , and import volumes increasing 6.2% year-on-year from January to November to 18.18 million mt from 17.12 million mt.

In H2 2024, market participants also noted that any uptick in deepsea prices attracted too many recyclers to sell into the Turkish market, which capped any sustainable upward momentum in spot scrap prices as eager sellers rushed to book deals.

US President-elect Donald Trump's incoming second term has also been cited as a determining factor by market participants. Trump's threats of tariffs against Canadian, Chinese and Mexican steel imports have sparked fears of global oversupply as exporters in those nations could likely seek alternative buyers.

This has already encouraged Turkish steel mills to keep rebar inventories low until Trump's protectionist policies are clearer, and consequently they have maintained a cautious approach to scrap procurement over the winter period.

Adversely, some sources expect Trump's protectionist plans to support the domestic US finished steel and scrap market, which could limit the scrap volumes available from the US, which is Turkey's largest origin of deepsea scrap. This could give some support to CFR Turkey scrap prices as Turkish mills could become more dependent on sourcing from European, UK and Baltic suppliers.

Another major determining factor throughout 2024 was the impact of Chinese steel exports, which grew to a near-decade-high amid a weak domestic Chinese market. Turkish mills were able to periodically import cheap Chinese billet as a substitute for ferrous scrap when prices and lead times were attractive enough, which in turn kept a cap on scrap prices throughout the year.

The Chinese government has announced various aggressive economic packages to support its struggling economy, namely their property and construction sector, including on Sept. 24 and Nov. 8 . But the announcements have largely failed to boost confidence in the markets due to a lack of clarity and an unconvincing long-term impact on consumer confidence.

China's export volumes between January and November reached 101.15 million mt, up 23% year over year. It is the first time China has breached the 100 million mt level since 2016, and with one month of the year left to account for.

Energy analysts project Chinese finished steel exports in 2025 will fall to around 97 million mt, depending on the impact of global antidumping measures on Chinese material and the possibility of US tariffs. However, continued weakness in Chinese domestic steel prices is keeping export offers competitive, and a lack of clarity on Chinese fiscal policy to drive domestic demand means Chinese steel will likely continue to impact global markets, including Turkish import scrap prices, in 2025.

In addition, some market participants have suggested that a potential rebuild in Syria -- where the rebel group Hayat Tahrir al-Sham (HTS) toppled the Assad regime in December -- could be a positive longer-term demand driver for the Turkish construction sector. Although this is contingent on the new government's viability, it could in turn drive steel demand and consequently prices for Turkish imports of scrap.