Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Fertilizers, Chemicals, Energy Transition, Natural Gas, Renewables, Hydrogen

December 17, 2024

By Nick Edstrom

HIGHLIGHTS

First ammonia cracker at port of Antwerp to start up in Q1 2025

Price spread between cracked ammonia, domestic RFNBO key variable

Cracked green ammonia seen acting as marginal ton in NWE

The announcement by industrial gases group Air Liquide that it will start up its first pilot ammonia cracker at the port of Antwerp in Belgium in Q1 2025 represents the beginning of the commercialization of ammonia cracking technologies.

Ammonia cracking is expected to play an important role in both emerging low-carbon ammonia supply chains to major end-user markets in Europe, as well as potentially emerging as the marginal ton (or kilogram) of electrolytic hydrogen supply close to major import hubs, market sources told S&P Global Commodities Insight.

The relevance of the technology that it is included in the Netherlands market regulator ACM's hydrogen and ammonia infrastructure access regulations, which will introduce requirements for ammonia cracker operators to offer negotiated access to third parties from February 2025.

In Northwest Europe, four ammonia cracker projects are advancing at the port of Rotterdam, while a number of other projects are advancing at the nearby Antwerp hub, market participants have said.

Midstream operator VTTI, which is part owned by Vitol and ADNOC, has announced that it is offering third parties the ability to request negotiated access to its ammonia cracker projects in Antwerp and Rotterdam.

The development of large-scale ammonia cracking represents a new area of focus for technology suppliers, such as KBR. Demand for the technology to be scaled up to potential throughput capacities of 300-350 mt/d has been driven by investment in low-carbon hydrogen transportation chains.

"Ammonia crackers are pivotal in unlocking the low-carbon hydrogen transportation economics, which is important for hydrogen-consuming regions envisaging the use of cheaper imports. The efficiency of cracking presents a significant challenge, but we believe the catalyst technology has made substantial progress, particularly with externally supplied heat, allowing users to explore various heat sources based on their cost and carbon intensity," Commodities Insight analyst Anri Nakamura said.

The scope for improved efficiencies is restrained by the energy requirements needed for the conversion of ammonia back into hydrogen, a Singaporean project developer looking at ammonia cracker projects told Commodity Insights in mid-2024. "The laws of chemistry dictate that you will incur 17% energy losses cracking the molecules." As a result, technology developers are focusing on minimizing the cost of meeting the heat requirements.

There are a number of ways that the energy required can be supplied, market participants said. Using the ammonia from the cargo as feedstock for the cracker's heat generation would have implications for the ensuing hydrogen yield from the cargo, lowering it to below 75%, when the lower energy density of ammonia compared with natural gas is taken into account.

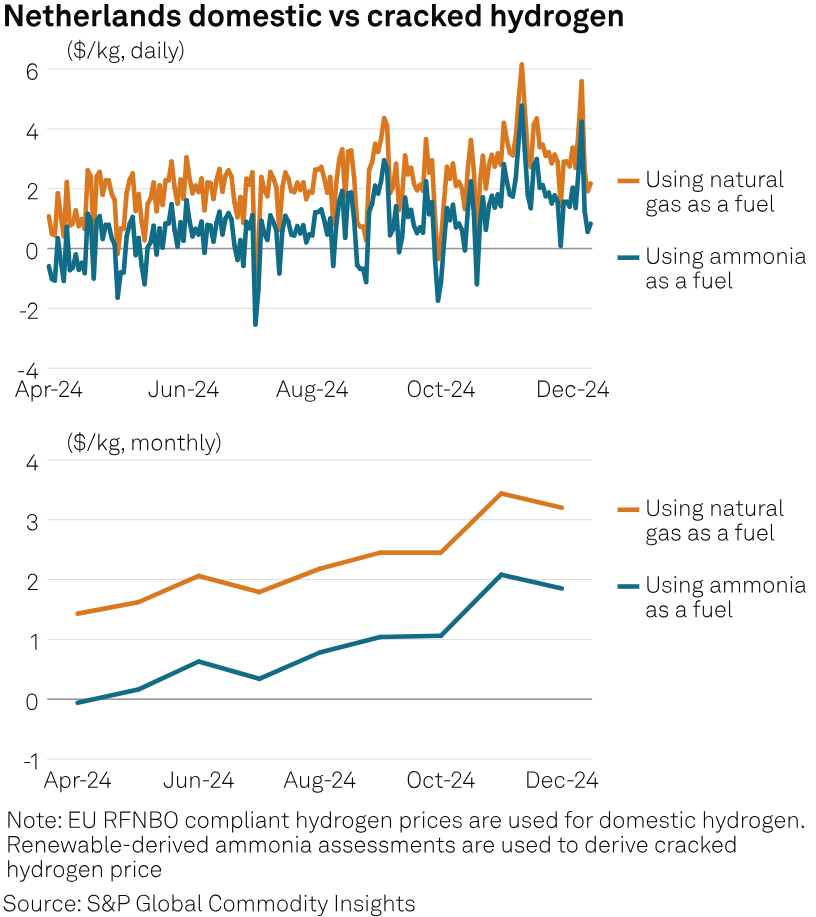

Platts, part of Commodity Insights, calculated the cost of hydrogen produced from electrolytic ammonia delivered to Northwest Europe at $7.99/kg on Dec. 10, compared with $8.82/kg for Platts assessed renewable hydrogen in the Netherlands.

The conversion spread is likely to understate the cost of ammonia cracking, as it does not include the cost of hydrogen storage, onward transportation via truck or pipeline, or the access fee for employing merchant cracking facilities.

In comparison, by using natural gas rather than low carbon ammonia as a feedstock, Platts calculated the cost of hydrogen produced from electrolytic ammonia delivered to Northwest Europe at $6.63/kg on Dec. 10, offering a discount of $2.19/kg over the cost of renewable hydrogen in the Netherlands.

The advantage of using natural gas is that the yield of hydrogen gained from converting the ammonia cargo into hydrogen could be as high as 95%, depending upon the configuration of the ammonia cracker's aftertreatment process.

A key obstacle to using natural gas as a feedstock for the cracking of the ammonia cargoes is the impact on the carbon intensity of the hydrogen product.

"It all depends upon [meeting] the RFNBO hydrogen requirements in the EU," one market participant told Commodity Insights in October.

Project developers are also understood to be focusing on low-carbon natural gas blends that could meet carbon intensity thresholds to lift cracker efficiencies to above 95%.

"This requires transparency in the full supply chain for the ammonia, including the shipping, to allow the carbon intensity of the fuels used to be tracked, but would potentially improve the economics of cracking significantly," another market participant said in November.

The premium between the cost of imported electrolytic ammonia cracked back to hydrogen over the cost of producing domestic RFNBO-compliant hydrogen is expected to make the cost of cracked hydrogen a key driver of domestic hydrogen price formation.

"We expect cracked green hydrogen to act as the marginal ton in markets near the Northwest Europe import hubs," one market trader said. "The Belgian hydrogen strategy explicitly relies upon imported hydrogen to meet the majority of domestic demand after 2030."

Other domestic European hydrogen producers are less concerned about the potential impact of cracked hydrogen on their business models. "It will be difficult for industrial end-users to source long-term offtake agreements for green hydrogen [in Germany] below our level of Eur7.50/kg," one electrolytic hydrogen producer source said in November. "We are not worried about it."

The impact of greenhouse gas equivalent emissions generated by onward transportation from import hubs, such as Antwerp, Rotterdam or Zeebrugge, are likely to limit the impact of cracked hydrogen prices within the European interior until the emergence of the European Hydrogen backbone in the early 2030s. This is currently understood to be no wider than 250-300 km away from the ammonia cracker, based on conventional fuel truck transportation.

As a result, some market participants expect to see a premium for lower carbon intensity cracked hydrogen to emerge, as it would both extend the expected transportation radius of the cracked hydrogen, as well as making a larger contribution to compliance with expected RED III targets for industrial end-users.