Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Energy Transition, Electric Power, Biofuel, Renewables

November 11, 2024

HIGHLIGHTS

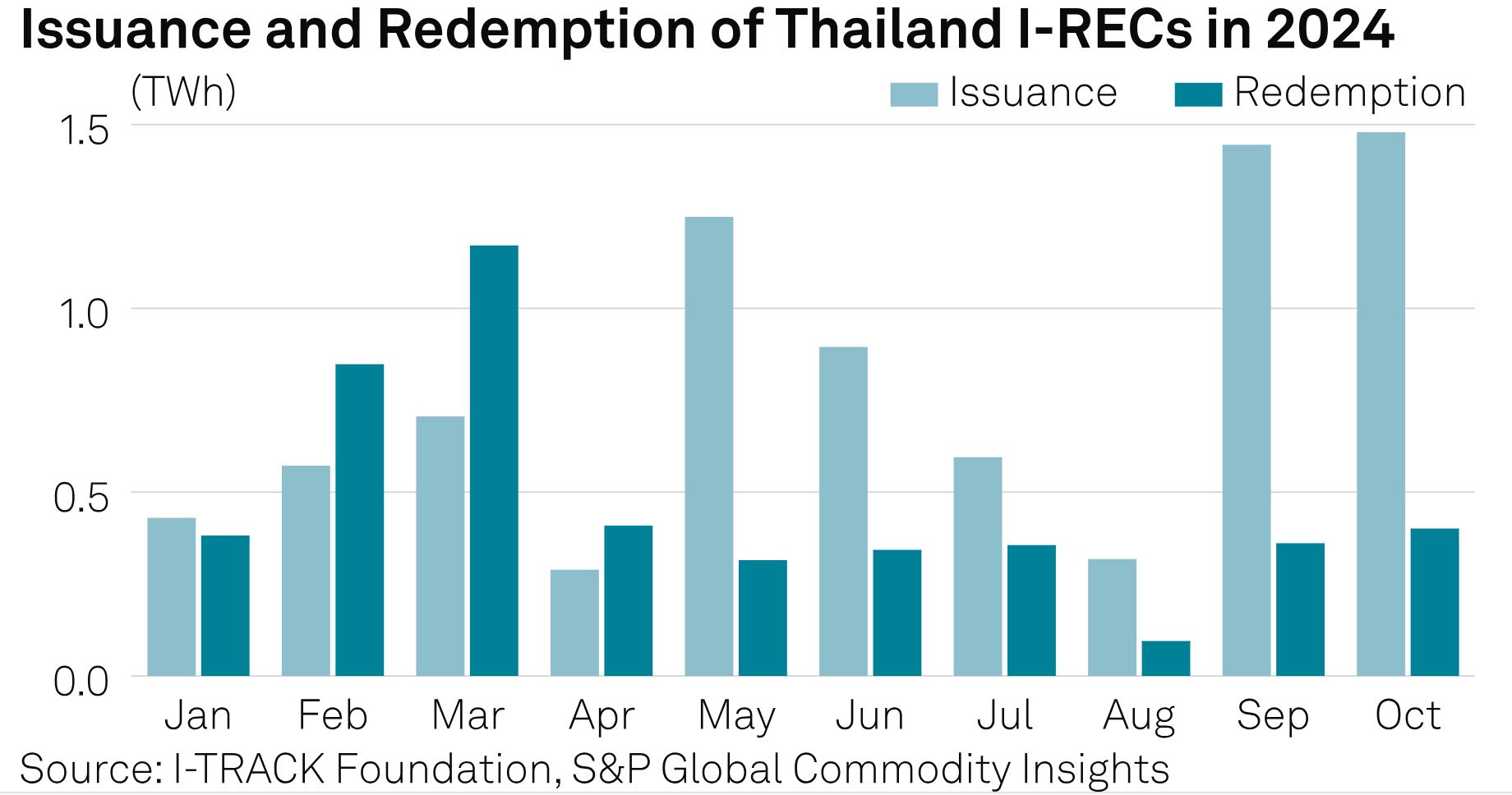

Highest issuance figure in Oct with 1.48 TWh issued from Jan to Oct

Despite the high issuance, redemption rates remained low, reaching only 401.11 GWh

The Thailand International Renewable Energy Certificate (I-REC) market continues to grapple with significant oversupply, despite recording its highest issuance figure in October 2024. The market saw an issuance of 1.48 TWh from January to October 2024, marking a 2.3% increase from the previous month. However, redemption rates remained low, reaching only 0.4 TWh, a modest 9.99% increase from the prior month.

Biomass I-RECs led the issuance figures with 1.1 TWh, reflecting a substantial 32.14% increase compared to September. In contrast, Hydro I-RECs saw a dramatic decrease, totaling 0.11 TWh, a 233% drop from the previous month. Wind I-RECs recorded a slight increase of 0.02%, totaling 0.04 TWh, while Solar I-RECs rose by 27.20%, reaching 0.19 TWh.

A local power generator highlighted the higher demand for biomass I-RECs, which is reflected in the large proportion of redeemed I-RECs for biomass. Despite the increase in issuance, sources indicate that these high figures contribute to the persistent oversupply in the Thailand I-REC market. "Back in 2022 and 2023, the prices for I-RECs were quite high, but that is not the case anymore. I think the current market activity is suppressed due to the overwhelming supply," a representative noted.

Market participants also noted, "There are ongoing discussions with the Ministry of Energy regarding energy strategy, with public hearings taking place in September, as mentioned by the Thailand Wind Energy Association. The outcome of these discussions is expected to shape the market outlook." Traders have observed that redemption rates for October are below expectations, but deals made now are seeing success.

Many participants are seeing increased demand for solar vintage 2024 as the year-end approaches, while redemption rates for October remain below expectations. Anticipating further demand in Q4, especially for larger deals, emphasizes the importance of having a stable price reference.

Despite sluggish activity in October, market participants remain optimistic. One source commented, "I think the demand for solar and wind will increase." Regarding biomass, the source added, "Biomass has a lot of requests."

Sources noted, "Some end users are looking for RE100-compliant biomass, but it's challenging to find in Thailand as only a few companies hold this certificate audit, most are non-RE100. Most end users seeking these certificates are from technology companies."

Generators also commented on the hydro I-REC market, stating, "We have sold all hydro certificates for vintage 2023, only certificates from vintage 2024 onward are now available."

As of Nov. 11, Platts, part of S&P Global Commodity Insights, assessed 2024 solar I-RECs at USD1.45/MWh, with 2023 vintage solar I-RECs at 75 cents/MWh, unchanged. Hydropower vintage 2024 I-RECs were assessed at USD1.26/MWh, with 2023 hydro I-RECs at USD1.00/MWh. Biomass vintage 2024 I-RECs were assessed at 65 cents/MWh, while 2023 biomass I-RECs remained at 45 cents/MWh, all assessments unchanged.