Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Energy Transition, Carbon, Emissions

January 13, 2025

HIGHLIGHTS

CCA bullish optimism amid Q1 program review draft

RGGI to remain volatile amid uncertainty surrounding program review

This is part of the COMMODITIES 2025 series where our reporters bring to you key themes that will drive commodities markets in 2025.

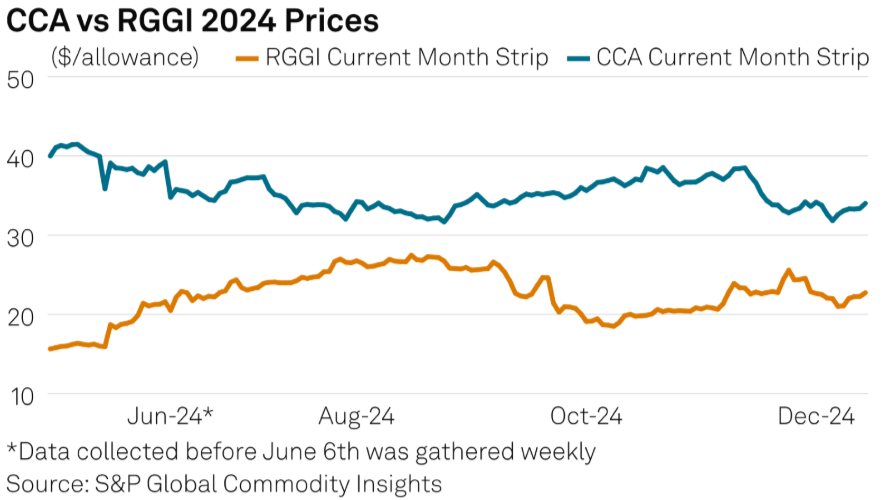

The US compliance carbon markets are poised for continued price volatility in 2025, driven by uncertainty surrounding the long-awaited program reviews and amendments, which market participants hope will address the unmet expectations of 2024.

The outlook for 2025 remains uncertain; while 2024 fell short of expectations, there is hope that leftover promises will be fulfilled in 2025. California Carbon Allowances and Regional Greenhouse Gas Initiative allowance prices will likely experience fluctuations as traders adjust their positions in response to upcoming auctions, regulatory updates and broader market dynamics.

Market sentiment for CCAs remains optimistic ahead of the program review scheduled for the first quarter. The program faced repeated delays in reviews throughout 2023 and 2024, putting its credibility at risk with its observers and participants. Any further postponements could significantly undermine confidence in the program, according to S&P Global Energy analyst Matthew Williams.

Some market participants see this as a make-or-break moment for the program, which must adhere to its proposed schedule without further delays, as failing to do so could jeopardize its future altogether.

"The market feels bullish on CCAs as long as there aren't further delays on the changes to the program in 2025," a New York-based trader said.

Initially, the California Air Resources Board had planned to implement these changes in 2024, with new regulations starting in 2025. However, at the July 10 workshop CARB revealed an "adjusted timeline to complete rulemaking by early 2025 means removals begin with 2026 vintage allowances." Due to regulatory delays, CARB has adjusted the timeline, and rulemaking will now commence in early 2025, with the changes expected to take effect starting in 2026.

A key aspect of the changes will be the introduction of removals starting with the 2026 vintage allowances. The October 2024 market notice issued by CARB confirmed these adjustments, and while the specifics are still under review, the industry is bracing for potential shifts in how allowances are managed, including the handling of removal credits and cap adjustments. The revised timeline for regulatory action has raised concerns about the delayed impact of these changes on the market, with analysts now looking toward 2026 as the starting point for full implementation.

"In California right now, just waiting for that announcement to come out, it's like watching paint dry," a Vancouver-based trader said.

Furthermore, California's climate policies are also facing potential federal challenges, especially with a Trump victory in the 2024 election. During the first Trump administration, the federal government filed a lawsuit against California over its linkage agreement with Quebec, arguing that the arrangement constituted an independent exercise of foreign policy by the state, thereby violating the Foreign Commerce Clause and the Supremacy Clause of the US Constitution. Energy analysts noted this could play a big factor in price behavior.

"There's a threat of the federal government coming down hard on green initiatives," a Houston-based broker said.

A revival of these challenges would add further uncertainty to California's climate programs, including its potential linkage to Washington.

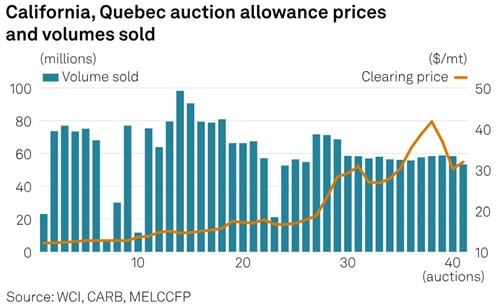

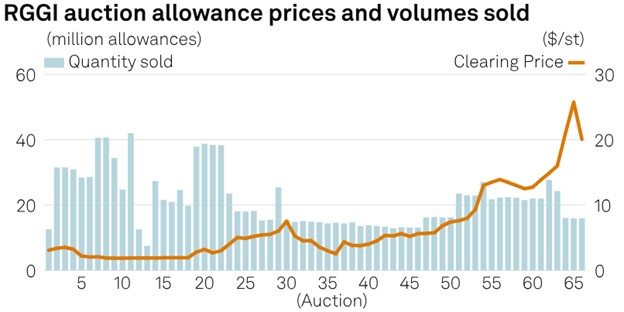

All these various factors will influence the 2025 quarterly auctions.

While market sentiment is generally bullish, the Regional Greenhouse Gas Initiative is the more unpredictable of the two markets for the year.

"RGGI could be more interesting, there's the whole court case in Virginia which will for sure make its way to the Virginia Supreme Court, as well as an interest in Pennsylvania and other states to drop the program," a Houston-based broker said.

RGGI is a multi-state program, and news of states potentially joining or leaving can significantly impact prices by influencing supply and demand dynamics. The most recent development involves a Virginia state court striking down the governor's repeal of the RGGI market, ruling it unlawful.

"A step towards reinstating the state to RGGI, and if this happens, it could lead to a rise in prices in the short term," Energy analyst Aldo Muller said on the recent court ruling news.

2025 will be the last year of the Third Adjustment for Banking Allowances, or TABA. It is a reduction in the states CO2 allowance base budgets equivalent to the private bank of CO2 allowances. According to Energy analysts, it has been a significant component in RGGI's efforts to manage CO2 allowances. Introduced as part of the 2017 Model Rule, the TABA was designed to address the surplus of banked allowances that had accumulated over the years.

"While the program review is certainly something to watch for 2025, the possibility of a fourth banking adjustment is a particular part of the program review to watch as the Third adjustment's last year is 2025," Energy Williams said.

Virginia's exit from RGGI in 2023 reduced the TABA by 4,329,115 allowances annually, to 14,761,175 in 2025 from 19,090,330 in 2024. If Virginia were to get reinstated in the program in 2025, this could play a major factor in supply and demand dynamics, potentially influencing prices and liquidity.

Looking ahead, the Third Program Review, released in September 2023, signals potential shifts in emissions caps and other program elements. RGGI's update includes delays in CO2 emissions cap reductions until 2027, which was initially expected in 2026. It also includes an increase in its Cost Containment Reserve and the introduction of a second reserve with a higher trigger price as well as discussions on how to accommodate additional states into the program.

Despite these updates, the timeline for emissions cap reductions remains uncertain. RGGI's modeling suggests 2027 as the likely date for cap reductions, although there is also some speculation that the reductions could be pushed to 2028.

All these various factors will influence the 2025 quarterly auctions.

Another pressing issue for RGGI states is offshore wind development. While offshore wind projects have been central to decarbonization goals, the Trump administration's approach to offshore wind could complicate progress.

Energy does not believe that the federal government will rescind existing offshore wind leases but that it could slow the approval process by deferring to ongoing court cases challenging wind farm projects. If federal agencies, particularly the Bureau of Ocean Energy Management, choose to side with plaintiffs opposing wind farms, the approval process for new leases and construction licenses could experience significant delays.

Energy does long-term forecasts for both of these markets.