S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Jul, 2022

By David DiMolfetta and Anser Haider

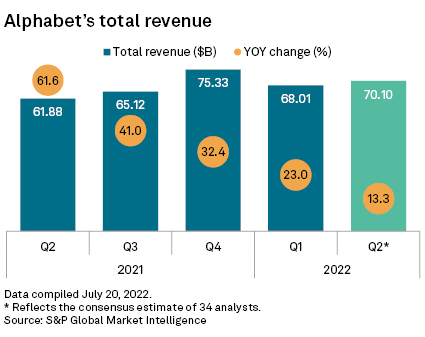

Alphabet Inc. is expected to report another quarter of slowing growth as macroeconomic headwinds and intensifying regulatory scrutiny weigh on its core advertising business.

Fears regarding a potential recession are driving many companies to scale back ad budgets, directly impacting Alphabet's growth prospects. The Google LLC parent company faces headwinds from difficult comparisons to 2021 when its revenue growth skyrocketed partly due to a rebound off early pandemic lows.

Alphabet is expected to report second-quarter revenue of $70.10 billion, up 13.3% from the prior year, according to S&P Capital IQ estimates as of July 20. The projected growth rate is down from 23% growth in the first quarter and significantly below Alphabet's performance through 2021.

"A challenging macro landscape and tougher comparisons will lead to a sharp deceleration in growth into the early parts of next year," said Angelo Zino, a senior equity analyst at CFRA Research.

Ad market falters

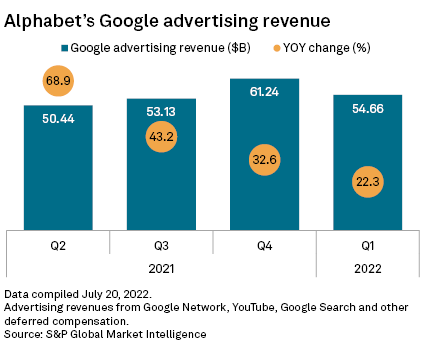

Alphabet's Google advertising segment, its largest revenue driver, pulled in $54.66 billion in the first quarter, up 22.3% year over year. The growth rate represented a deceleration from the past three quarters, and analysts expect this trend to continue.

"In what we believe will be the first of many adjustments to our estimates given deteriorating visibility, we decrease our forecasts for Google's advertising businesses as we receive marketer feedback of declining budgets owing to macro uncertainty,"Credit Suisse analyst Stephen Ju wrote in a recent analyst note on the company.

Google's search segment is expected to show more resiliency.

"Although Q2 could see some lumpiness from Russia/Ukraine, China COVID-19 constraints, and supply chain headwinds, we believe Google's Search business is better positioned than peers that also had to contend with other noise like Apple [Inc.]'s ad tracking changes from a year ago," said CFRA's Zino.

Regulation risks

Alphabet is also contending with growing pressure from regulators seeking to rein in the company's market power in the online search and advertising businesses. The company faces at least two-dozen antitrust probes in the U.S. and around the world, including several in the European Union.

The Wall Street Journal reported earlier this month that Google offered to split parts of its ad-tech business into a separate unit under the Alphabet umbrella in an effort to appease American antitrust enforcers. It remained unclear whether that would be enough to address the concerns raised in a pending U.S. Justice Department lawsuit alleging the company holds a monopoly in the search advertising market.

"I don't know what that [proposed business split] is actually accomplishing as far as ameliorating the concerns people have about Google having such an outsized share at every level of the ad-tech stack," said Jesse Lehrich, co-founder of Accountable Tech, a group advocating for regulation and reform of tech giants.

A more serious concession would be for the company to either sell off the advertising segment to a third party or allow ads to be purchased outside of its own ad brokerages, Lehrich added.

A spokesperson from Google declined to comment on the matter.

In 2008, the U.S. Federal Trade Commission greenlit Google's purchase of DoubleClick Inc. after an eight-month investigation concluded that the deal was unlikely to substantially lessen competition. That deal helped to propel Alphabet into the search advertising dominance it has today, said Tejas Dessai, internet research analyst at New York-based exchange-traded funds research firm Global X ETFs.

"Proving Google acts in a way that it hurts the market and in a way that it hurts the end-consumer is going to be a bit tricky," Dessai said.

Shares in Alphabet were down 21.1% year-to-date as of market close July 21, in line with declines seen by the tech-heavy Nasdaq.

Cloud growth

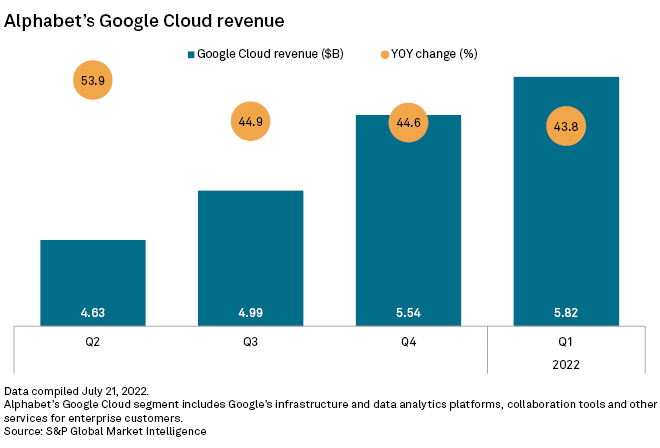

Outside of advertising, Alphabet's Google Cloud segment remains a fast-growing portion of the company's business and the largest source of non-ad revenue. The segment — which includes Google's infrastructure and platform services, collaboration tools and other services for enterprise customers — logged first-quarter revenue growth of 43.8% year over year to $5.82 billion.

CFRA forecasts that Google Cloud grew 37% in the second quarter and expects a similar growth rate for the second half.

"Cloud still represents only 9% of revenue but remains by far the most important growth story, in our view, as the economy grinds to a halt," Zino said.

Although Google Cloud remains unprofitable, with an operating loss of $931 million in the first quarter, Zino expects the business to reach profitability in the next eight to 12 quarters.

Credit Suisse expects second-quarter Cloud segment growth of 31%, but Ju said this forecast could prove conservative given secular tailwinds among cloud providers.