Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2021

By Zoe Sagalow

Source: Spencer Platt/Getty Images News via Getty Images

The Federal Reserve is developing systemwide constraints on securities transactions, including restricting active trading, as observers question how they will be enforced.

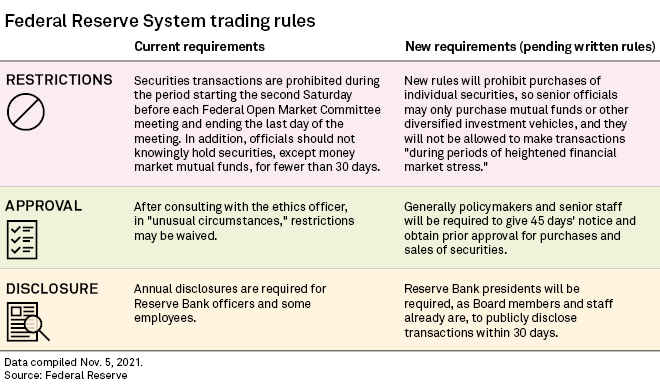

Different sets of ethics and disclosure rules have applied depending on whether an individual worked for the Board of Governors, a Fed regional bank or was a member of the Federal Open Market Committee, which is composed of governors and regional bank presidents. And those rules have been enforced in varying ways.

The upcoming rules, which were announced on Oct. 21, will apply to regional bank and Board policymakers and senior staff, according to the Fed.

Enforcement is critical, said Francesco Trebbi, a business and public policy professor at the University of California, Berkeley's Haas School of Business.

"Many of these rules about disclosure are sometimes circumvented because of lack of enforcement," he said in an interview.

Enforcement plans haven't been completely figured out yet.

One key question is whether the U.S. Department of Justice and the Securities and Exchange Commission are "empowered to take action," Marti Subrahmanyam, a professor at New York University's Stern School of Business, said.

The new rules are "not going to do us any good if there's no enforcement," he said in an interview.

How rules will change

The existing system "proved to have weaknesses in it, and part of that was it wasn't enforced uniformly across the system," Fed Chair Jerome Powell told reporters Nov. 3. He added that the system included ethics officers at the 12 regional banks and at the Board, and compliance was "a little bit different and uneven."

Earlier this year, after their stock trades in 2020 raised ethics concerns, Federal Reserve Bank of Boston President Eric Rosengren and Dallas Fed President Rob Kaplan retired.

The new rules will restrict active trading, prohibit the purchase of individual securities and increase the timeliness of reporting by Fed policymakers and senior staff. As a result, senior officials will only be allowed to purchase diversified investment vehicles, like mutual funds.

Reserve Bank presidents will also be required to publicly disclose financial transactions within 30 days, as Fed board members and senior staff currently do.

"I suspect there is broad agreement that the trading ban was long overdue," said Bert Ely, principal of Ely & Co. Inc., a bank consultancy. "I for one was amazed that the trading ban had not always been in place; the Fed's reputation certainly has been damaged by these recent revelations."

The new requirements do not address the issue of influence by industry on regulators through regulatory capture or a revolving door between government and business — when economists leave the Fed for lucrative jobs at investment banks or consulting firms, for instance, said Trebbi.

"Those are really the distortionary forces at play," he said.

Are the new requirements strong enough?

The new rules are insufficient given the outsized impact Fed policy actions have on financial markets, according to Simon Johnson, a professor and head of the global economics and management group at the MIT Sloan School of Management.

"The Fed does not want to acknowledge the broad influence it has on asset prices through the existence and potential of big quantitative easing programs, which we've had since basically 2008 [or] 2009 and which were expanded massively in COVID," he said.

Johnson suggested alternative rules that may be more effective.

"One thing you hear from Fed old-timers is you should go into the job with a diversified portfolio of mutual funds and just don't change it," he added. "That's a very simple, easy rule. If you need to rebalance your portfolio, you could agree at the start of the job" on a plan.

Richard Berner, a finance professor at New York University's Stern School of Business and co-director of its Volatility and Risk Institute, disagreed, saying "the new requirements seem sufficiently restrictive."

Some requirements, such as holding investments for at least a year and giving 45 days' notice, seem more restrictive than rules at many financial services firms, added Berner, who is also a former member of the Fed's research staff.

Deterrence risks

Analysts wondered whether some candidates could be dissuaded from holding positions because of these requirements.

"An interesting question is whether any senior Fed officials will leave the Fed because of the trading ban — watch for early retirements," Ely wrote. "The great unknown, and unknowable, is what difficulties will the Fed experience in hiring senior executives because of the new trading ban."

That could be a problem depending on the details of the rules, according to James Angel, associate professor at Georgetown University's McDonough School of Business, who teaches about insider trading among other topics.

"There is a tradeoff: Making the ethics rules too strict can keep us from getting the best people to manage the money supply, while making them not strict enough leads to corruption and scandals," Angel said.

Enforcement could prevent future problems.

"On the surface, these appear to be tough rules," Ely said. "The big question, though, is how aggressively will they be enforced?"